cover 30

Donald Trump has seemingly backed a theory suggesting he is intentionally crashing the stock market with his controversial tariff strategy, all in a bid to push the Federal Reserve into slashing interest rates.

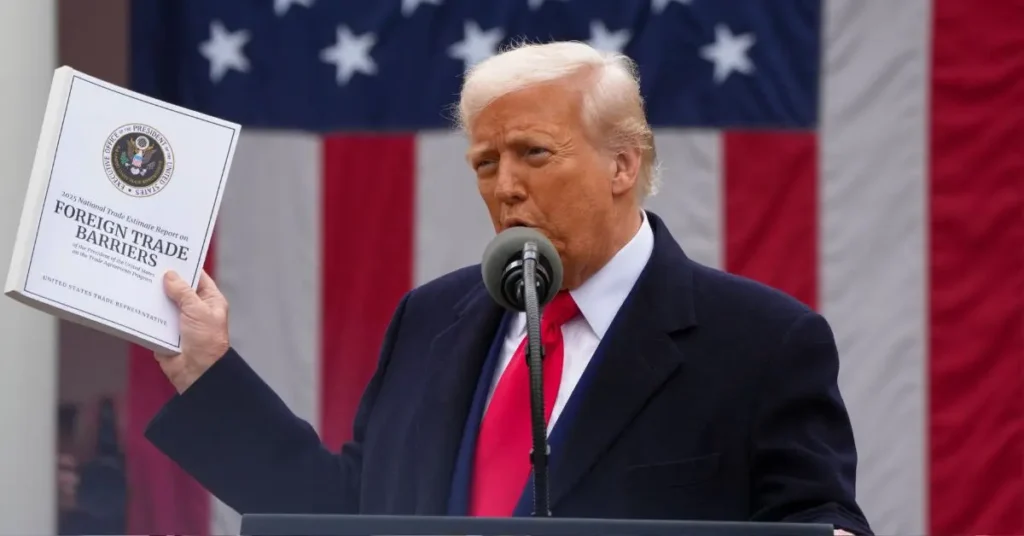

The president recently shared an AI-generated fan-made video, which portrayed his tariff plan as a “genius chess move.” The strategy is said to theoretically enable the U.S. to refinance trillions of dollars in national debt.

Trump posted a link on Truth Social to a video that claims he is “Purposely CRASHING The Market.”

The one-minute clip, originally shared on TikTok, was released before the president’s “Liberation Day” announcement on April 2. The video asserts: “Trump is crashing the stock market by 20 percent this month, but he’s doing it on purpose. […] Here’s the secret game he’s playing, and it could make you rich.”

The AI video also claimed the controversial tactic has Berkshire Hathaway billionaire Warren Buffett’s support, but the veteran investor shot down this claim.

Buffett shared a statement denying the claim through his firm on Friday. The video has also since received a community note on X, formerly known as Twitter, clarifying the investor’s stance.

His statement read: “There are reports currently circulating on social media (including Twitter, Facebook and TikTok) regarding comments allegedly made by Warren E. Buffett. All such reports are false.”

Trump’s post highlighted that the president is supposedly trying to “push cash into treasuries, which forces the Fed to slash interest rates in May. These lower rates would give the Fed the ability to refinance trillions of dollars of debt very cheaply. It also weakens the dollar and reduces mortgage rates. Now, it’s a wild chess move, but it’s working.”

The video continued: “What about his tariffs? I’ll tell you, it’s a genius play. It forces companies to build here to dodge them. It also compels farmers to sell more of their products domestically, driving grocery prices down. We’ve already seen this with eggs.”

The video also noted: “Now, remember, 94 percent of all stocks are owned by just 8 percent of Americans. So Trump, he’s taking from the rich short-term and handing it to the middle class through lower prices.”

In a follow-up post, President Trump directly urged Federal Reserve Chairman Jerome Powell to cut interest rates and “stop playing politics.”

Trump wrote: “This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image and quickly. Energy prices are down, Interest Rates are down, Inflation is down, even Eggs are down 69%, and Jobs are UP—all within two months. A BIG WIN for America.”

Trump’s comments came after Powell issued a bleak forecast on Friday, as the president sought to challenge the chairman’s economic outlook. At an event just outside Washington, D.C., Powell warned: “We face a highly uncertain outlook with elevated risks of both higher unemployment and higher inflation. While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent.”